how to pay taxes on coinbase

Coinbase is the most recent major cryptocurrency exchange to offer a Visa debit card. The exact rate depends on a few factors but its almost always lower than the rate youd pay on short.

Coinbase May Have A Savior In Blackrock But Crypto Concerns Remain Cnn Business

Itll just pull the numbers required.

. Individual Income Tax Return along with IRS Form 8949 Sales and other Dispositions of Capital Assets and IRS. You can find this in the Coinbase Wallet app at the top of the extension. 1 Coinbase Taxes Explained In 3 Easy Steps.

Individual investors should report NFT income via IRS Form 1040 US. So you pay capital gains on 40000 30000 10000. Coinbase Tax Reporting.

If the coins you received as a gift are. With the way crypto is currently taxed the tax free designation probably only applies to the value when granted so any gains on top of that would be taxable value. You only owe taxes if you spend or sell it and realize a profit.

When and how is. Just get your public address from the blockchain you want to connect with your crypto tax app. Learn how to pay your Coinbase taxes how to reduce crypto taxes owed and discover what is the best cr.

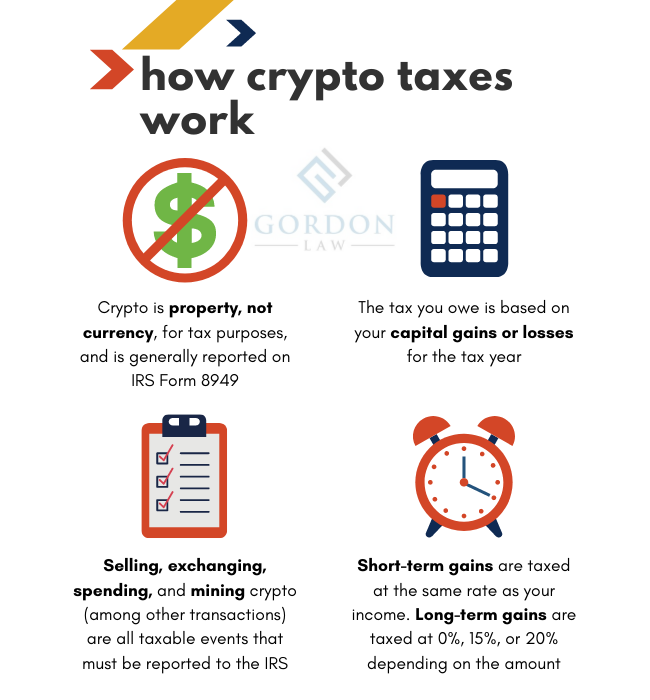

How to File Crypto Taxes with Coinbase How to Do Crypto TaxesHow to Pay Crypto Taxes in the USDoes Crypto Get TaxedHow Crypto Taxes Work on Coinbase FULL G. Coinbase will report your transactions to the IRS before the start of tax season. These gains are taxed at rates of 0 15 or 20 plus the NII for higher incomes.

When you pay Income Tax on crypto - you need to identify the fair market value of your crypto in your countrys fiat currency on the day you received it. Do you have to pay taxes on Coinbase. If you hold your crypto for no more than 12 months before selling it youll be subject to a short-term capital gains tax rate ranging from 10 to 37.

Youll need to do this. The Coinbase debit card offers a percentage of your purchase as a cash-back reward. If you held onto your crypto for more than a year before selling youll generally pay a lower rate than if you sold right away.

If you earn 600 or more in a year paid by an exchange including Coinbase the exchange is required to report these payments to the IRS as other income via IRS Form 1099. Your cost basis is original cost when the coins were bought meaning 30000. The 1099-MISC from Coinbase includes any rewards or fees from Coinbase Earn USDC Rewards andor staking that a Coinbase user earned in the previous tax year.

Long-term gains are taxed at a reduced capital gains rate. 2 Understanding crypto taxes Coinbase. 3 Crypto and US.

You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger. That being said there are. If you hold that same.

If you sell or spend your crypto at a loss you dont owe any taxes on the. You only have to do one of two things to get your Coinbase-Pro data uploaded. If you made 600 in crypto by an exchange such as Coinbase the exchange is required to use Form 1099-MISC to report your.

Use your APIs to connect your Coinbase-Pro account to Cointelli. 12570 Personal Income Tax Allowance. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

Your Coinbase taxes dont have to be complicated. Heres some good news for crypto taxes.

Coinbase Helps U S Customers With Tax Tools

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/TMYEIGMYPBCXLOC2H4OTTBLIWA.jpg)

Coinbase Ditches Us Customer Tax Form That Set Off False Alarms At Irs Coindesk

What To Do With Your 1099 K From Coinbase Gemini Or Gdax For Crypto Taxes By Lucas Wyland Hackernoon Com Medium

Paying Taxes On Bitcoin Is Surprisingly Simple

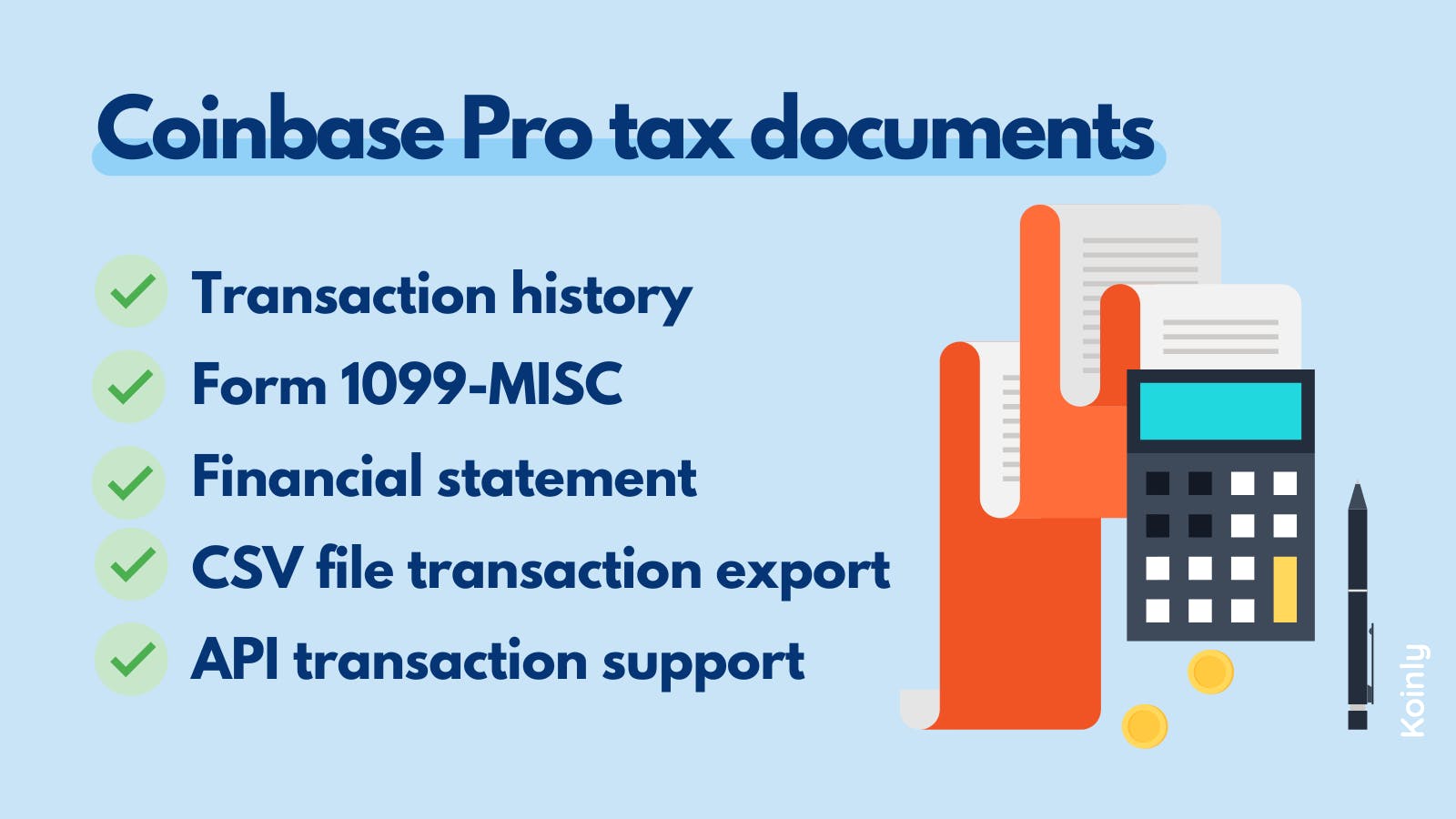

The Ultimate Coinbase Pro Taxes Guide Koinly

What Is The Coinbase Debit Card And How Is It Taxed Zenledger

Coinbase Tax Documents In 2 Minutes 2022 Youtube

Tweets Dont Tax Advice On Twitter Fintaxdude Coinbase This Is Funny We Are Not Required To Issue A Form 1099 B Or Issue Reporting To The Irs If You Sell Trade

.jpeg)

How To Do Your Coinbase Taxes Coinledger

Coinbase Adds A Module To Address Cryptocurrency Taxes Tech Co

Does Coinbase Provide Tax Forms Understanding Coinbase Taxes Zenledger

![]()

Cointracker Partners With Coinbase To Offer Crypto Tax Solutions Cointracker

How To Download Your Coinbase Transactions Node40

Coinbase To Customers Don T Forget To Pay Taxes On Bitcoin Gains Coindesk

Your Crypto Tax Questions Answered Lexology

Coinbase Review Pros Cons And Who Should Set Up Account

Turbotax And Coinbase Allow Users To Convert Tax Refunds To Crypto The New York Times